Coach’s Corner – “If Investing is Exciting, You’re Doing it Wrong!”

If you were to define what kind of investor you are, would you say you’re someone who is relatively conservative? Are you aggressive with your money? …or maybe you’re one of the many who would consider yourself to be a “moderate” investor – where you want to focus on growing your money, but you don’t necessarily want to take the risk required to own an “aggressive” retirement portfolio?

Regardless of who you are, where you fall in the continuum of risk, and what kinds of investments you own, one of the biggest lessons everyone must learn at some point in their life is that, for your serious, long-term retirement dollars – the money that ensures you keep up the lifestyle you’re used to – it shouldn’t be all that exciting.

If you own a portfolio that’s “fun and exciting,” chances are, it’s relatively aggressive, and the stock market just happens to be doing well at the moment. That same retirement portfolio, when the market turns south, starts to feel like the rollercoaster from hell.

If you’re a short-term trader, volatility can be your best friend. But when you’re a long-term investor, volatility in your long-term retirement plan can either feel like a bump in the road, or like driving a trolley 1,500 miles across the country at 70 MPH (not so comfortable).

Most investors aren’t aware of the fact that you can achieve the same (or at least similar) returns with less volatility. Furthermore, math is an interesting subject. Some of us hated it in school, some of us loved it… but there’s no arguing with the fact that math can do some strange things to our psyche, causing us to believe things that just simply aren’t true.

First off, most people thing of the growth in their retirement portfolio in terms of “Rate of Return” (or ROR). That’s fine as long as you’re in the accumulation phase of life, growing your money to make work “optional” someday.

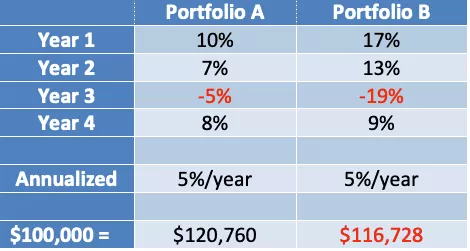

If you’re still working, and especially if you’re retired, you need to focus more on something called Compound Annual Growth Rate (or CAGR). Never mind the acronyms and minutia – in fact, ignore this whole paragraph if you want. Instead, just feast your eyes upon the mind-blowing math, below…

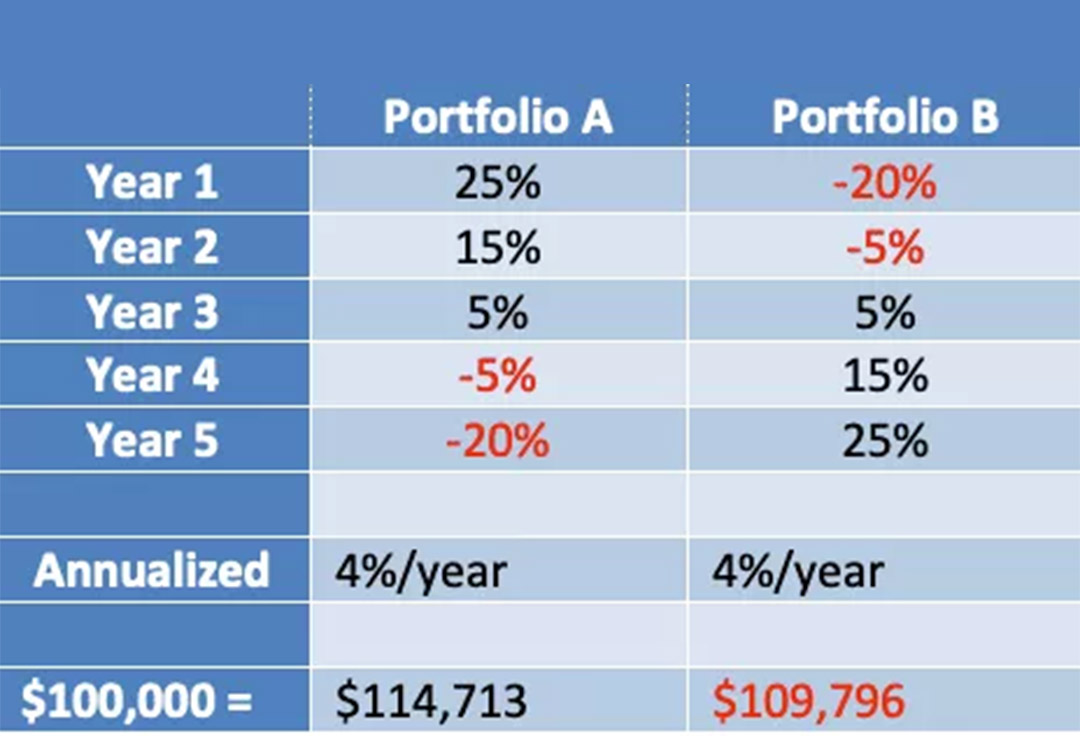

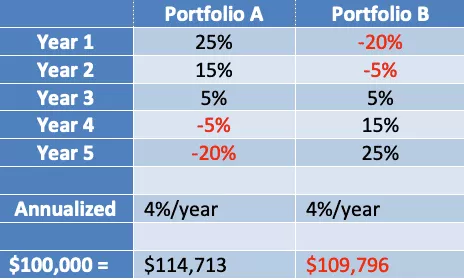

In my first example, I wanted to teach you how the same ROR, turned upside-down, can make a big difference in your end result. “Portfolio A” starts with a bull market for the first three years (think of this like retiring and then getting a nice, positive three years of results). “Portfolio B” on the other hand, starts with a bear market, but ends with the same results that “Portfolio A” started with.

Understanding that no one can control what kind of market we’ll face at any given time, you can see how starting the portfolio with a few good years results in a higher total result, even though the annualized return in percentages is exactly the same (at 4%/year for both portfolios).

Hugely different, actually.

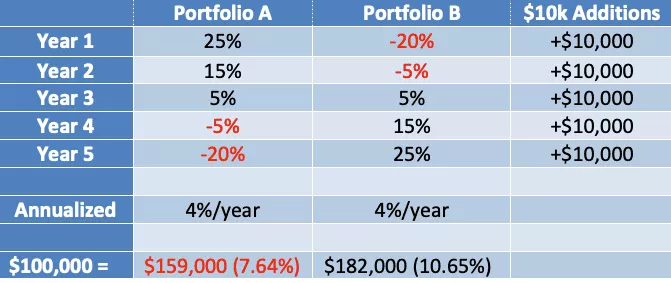

Not only is the total dispersion between the two numbers wider, but the winning portfolio is completely different than the one above that was left alone, without any additional contributions (and keep in mind, the total ROR is the same again, at 4%/year!).

Why? Well… because “Portfolio B” was given the opportunity to invest more money while prices were lower, it ended up with more money in the end. “Portfolio A” on the other hand, had more to lose when the bear market arrived, and when those negative numbers hit big dollars, we find ourselves saying “The bigger they are, the harder they fall.”

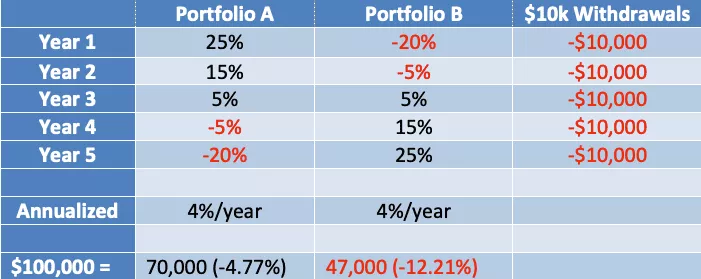

Are you surprised?! “Portfolio A” did better because, while money was being withdrawn, they were getting propped up early on by some good years in the market. “Portfolio B” struggled because not only were they withdrawing $10,000 each year, but they were losing money along with their withdrawals, which created a compounding effect and thus, a larger drawdown in portfolio value, even though again, the total ROR was exactly the same!

This time, you can clearly see that “Portfolio B” experiences higher volatility (bigger ups and downs) than “Portfolio A,” right? Isn’t it interesting that the two portfolios generate the exact same ROR at 5%/year? Even more fascinating – don’t you find it interesting that “Portfolio A,” the one with less volatility, actually performed better, even though the ROR was the same and the risk was clearly lower than “Portfolio B?”

Sometimes your trip starts out rough. Someone forgets their suitcase at home and you have to turn back to pick it up. You come across a few train crossings that stop you, heavy traffic, and the beginning of the trip can start so bad that you just want to give up and go home… but no one does that. We just continue on to our vacation destination, don’t we?

Well… we should do the same in our retirement portfolio, because sometimes the trip starts off smooth, with blue skies and barely any traffic to compete with. Much later in the trip, however, you run into 2 hours of parking-lot-like traffic, only to be followed by a white-out snowstorm and as a result, you have to slow down, stop, or even reverse progress (i.e. – detours). Still, you continue onto your vacation destination.

Not to complicate matters, but the kind of car you’re driving is a lot like the amount of risk and thus, volatility that exists in your portfolio. Two families can go on the same exact trip, experience the same traffic, detours, and weather, but have a completely different experience along the way.

One family of four might pack their bags into an Aston Martin Rapide, a rear-wheel drive four-seater race car with a 6.0L, V-12 engine and a top speed of 203 MPH. It might not be the most comfortable ride in the world, and you might get stuck in the snow… but you’ll get there fast, as long as you can tolerate the downside to this aggressive (but very cool-looking) vehicle!

Be sure to have a financial plan in place (a road-map) so that you can reach your destination (retirement and beyond!) in conservative and timely fashion, all while ensuring your money lasts longer than you do!

‘till next time!

Adam