Coach’s Corner – “Russia, Ukraine, and The Stock Market”

When J.P. Morgan was asked “What is the stock market going to do,” he responded by saying:

“It’s going to fluctuate.”

Never has this Q&A exchange been more relevant than now, as Russia stands on Ukraine’s doorstep, and the stock market experiences one of its worst starts to any year… ever.

There’s an old saying that “The stock market takes the stairs up, and the elevator down,” and if there’s one question I often hear from investors, it’s:

“When is the best time to invest my money?”

You see, most people don’t want to invest their money near all-time highs in the stock market. As humans, we’re wired to want a bargain… a deal, per se.

The not-so-obvious problem is that, well… we’re human, and money is an emotional thing. So as soon as the market goes on sale and provides a dip, pullback, or correction, we don’t want to invest our money because it doesn’t “feel” good.

Instead, the news, radio, and internet take hold and the second thing we think about is the clearance sale in stocks going on today, while the first thing on our mind is “I’ll invest once this whole Russia invasion thing is over with.”

The problem with this way of thinking is, of course, we have no idea when Russia will invade Ukraine, or if they’ll invade at all! Let’s say news comes out in the next few days that Putin has come to terms and decides to stand down… stocks could rise faster than you can say “Vodka,” and before you know it, you’ll be waiting for “the next time” the market pulls back or corrects to invest your money.

To add some perspective to my thoughts here (because I don’t want to continue spewing my opinion all over this article), here are some cold, hard facts.

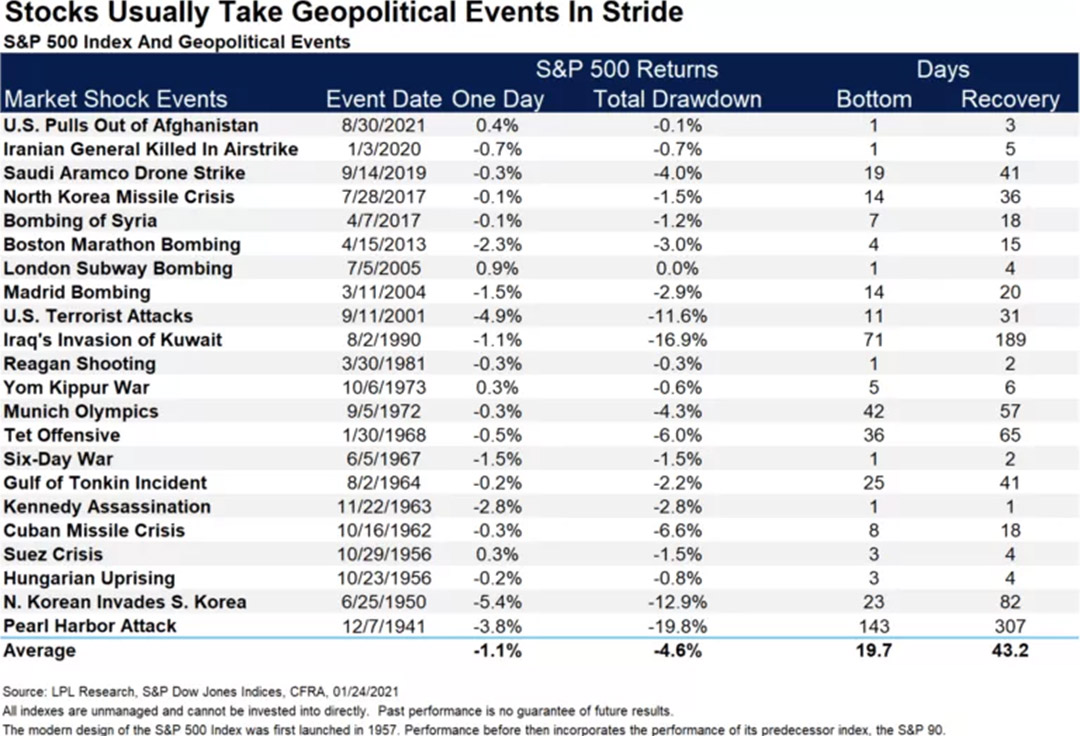

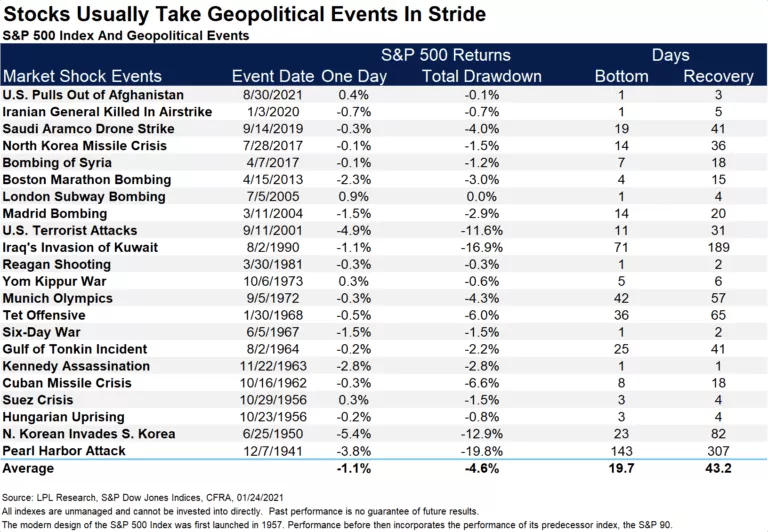

In a recently recorded podcast, I referenced several, major geopolitical events, going all the way back to the Pearl Harbor attack in 1941. Notice the following interesting numbers:

- The average one-day drop in the stock market was only -1.1%

- The worst two were -4.9% (WTC Attack) and -2.8% (Kennedy Assassination).

- The total average drop, from the beginning of the crisis until the end was -4.6% with

- The worst two being -19.8% (Pearl Harbor) and -16.9% (Iraq’s Invasion of Kuwait).

- The average number of days it takes for the market to bottom after a crisis is only 19.7 days

- The two longest were 143 days (Pearl Harbor) and 71 days (Iraq/Kuwait), and

- The total time to full recovery (back to even) was 43.2 days

- The two longest being 307 (Pearl Harbor again), and 189 (Iraq/Kuwait… again).

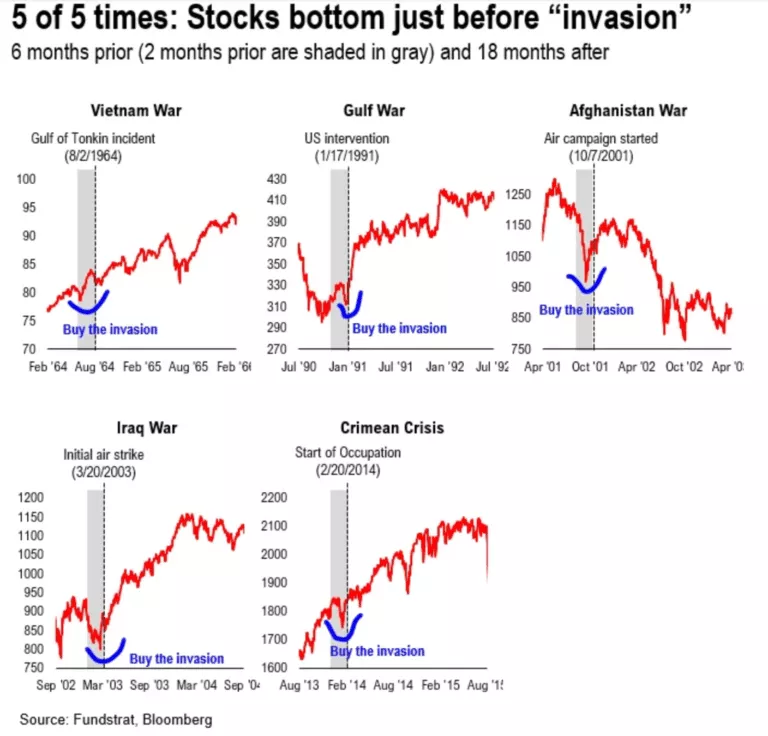

On the other hand, many of the other crises listed above are events we already knew were coming. So, is it possible that a lot of the fear and potential loss might already be baked into the market and behind us at this juncture?

Here’s an image (below) put together by FundStrat that shows what happened before, during, and after the last five invasions that have taken place in the past 58 years. With the exception of the market action that took place after the 9/11 WTC attack (which, by the way, took place right in the aftermath of the dot-com bubble), the rest of the charts teach us that some, if not much of the damage had already been done by the time the invasion took place. Might the past rhyme with the present?

There are several other events that I didn’t share above that affected the market in one way or another. In fact, there have been times when stock trading has been halted and the market has been closed for emergency reasons, including but not limited to:

- Lincoln’s assassination (one week)

- The death of Queen Victoria, King Edward VII, and King George V

- The death of J.P. Morgan

- The outbreak of World War I (four months)

- A day when there was no heat on the floor of the NYSE

- National day of mourning for Martin Luther King, Jr.

- Hurricane Gloria, and of course…

- 9/11 (for multiple days)

There’s this book I used to read to my boys when they were younger called “Mouse’s First Halloween,” and on each and every page of the book, the page ends with the phrase, “See… not so scary after all.”

To be clear, I’d never want to diminish the human cost or magnitude of sacrifice when it comes to geopolitical events, wars, and invasions. I’m just suggesting that, when focused on our hard-earned, long-term retirement savings, that maybe we ought to make sure we’re observing it all through the proper lens – or at least one that holds the proper historical perspective in mind.

‘till next time!

Adam