Coach’s Corner – “The Stock Market’s ‘On Sale!’”

We always want our clients to call us if they’re feeling uneasy. At times like these, when the stock market is really, really struggling, money can get emotional, the process can get frustrating and we’re always here to lend an ear, followed by sound wisdom, advice, and ultimately, peace-of-mind.

I start this Coach’s Corner article saying this because we’ve only had two phone calls this month with concerns about the stock market.

The first person called because she was legitimately fearful about how fast the market was declining and needed to talk about what was going on, and what our plan was.

The second person emailed today and the subject line was “Stock Market,” and the body read, “Safe to say the stock market is on sale right now? …probably a good time to invest some money?!”

Two different pieces of communication, both polar opposites, but I’d argue that, from the standpoint of being a successful investor long-term, neither would be necessarily “better” than the other.

I mean sure, one could argue that Investor #2 is being more fiscally responsible, has the right attitude, and is capitalizing (proactively, I might add) on what the stock market has done recently.

However, you could also argue that Investor #1 might be a completely different individual with a totally different situation, background, and story – perhaps they’re single, living on one source of fixed income, retired, and with no additional cash to invest today? Yup…

If you haven’t noticed what’s been going on in the market this last several months, that’s a good thing! It could mean you’re the type of investor that tends to turn a cold shoulder to times when the market is struggling because you know it’s just going to cause unwanted stress and anxiety. You likely also hold the assumption that things will come back and get better (and they will!).

For those who don’t want to know what’s been going on, then skip these bullet-points.

- The “stocks within the stock market” have been declining for roughly 11 months already,

- The S&P500 has already been down more than -10% this year (in only 3 weeks!),

- The Nasdaq index reached as much as -19.72% in the same amount of time, however

- More than 70% of the stocks on the Nasdaq were down -20% or more,

- The average Nasdaq stock was down more than -40%, then

- The Russell 2000 index was down as much as -21.44%, and

- Monday’s worst-performing stocks are already down as much as -42% year-to-date, including:

- Ford (F) down as much as -24.1% off its highs

- Tesla (TSLA) down as much as -28.3%

- Netflix (NFLX) down -39.5% YTD and more than -48% off its 52-week highs

- Moderna (MRNA) down -42.4% YTD and more than -70% off its 52-week highs.

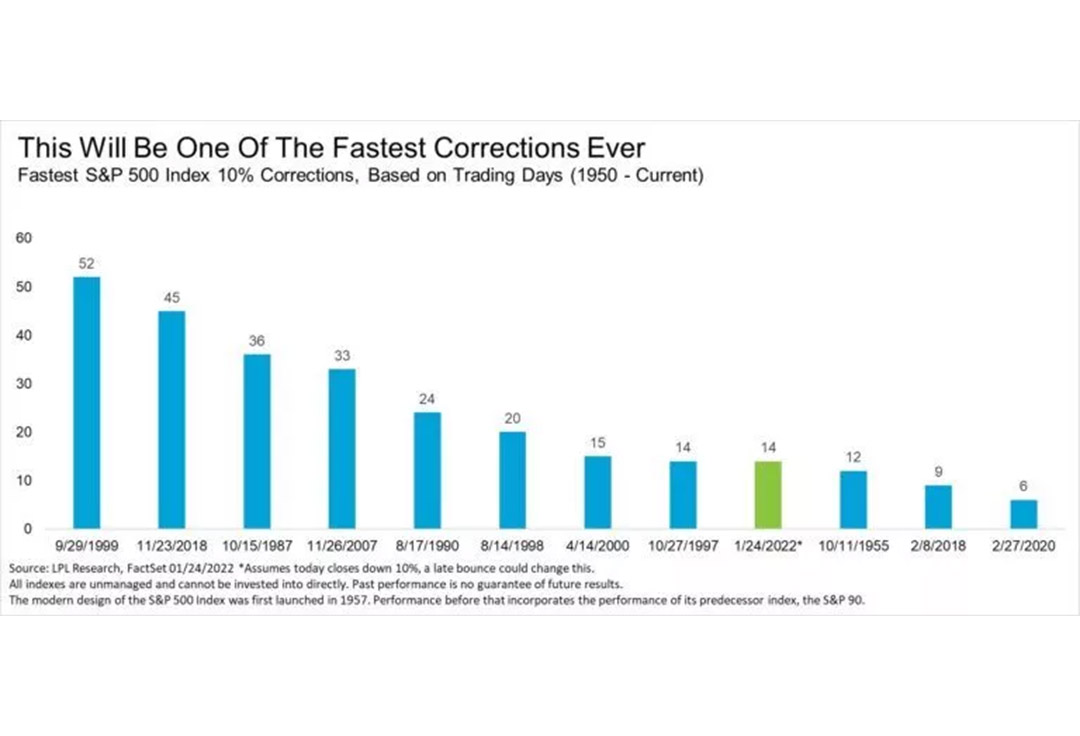

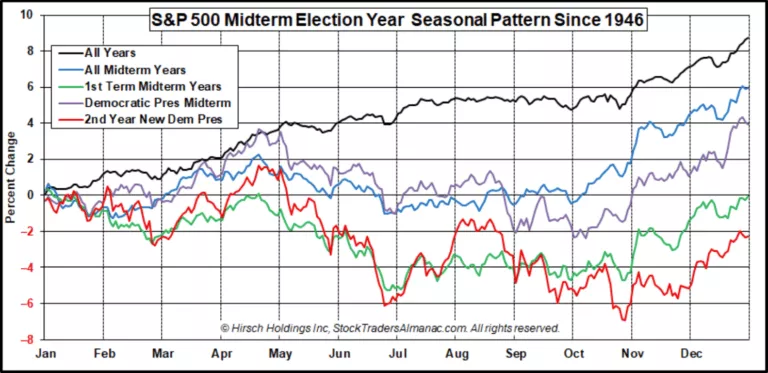

…as it turns out, the current market correction just happens to be one of the fastest, ever:

It was just a matter of time before either these big, huge companies “pulled the smaller ones” up… or if the weight of the thousands of smaller companies sinking pulled the big companies under water. In this case, it was the latter that came to fruition, starting in November.

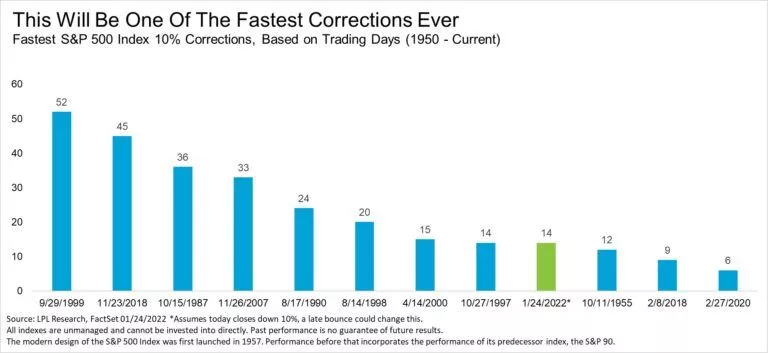

The second reason for the increased volatility is that we’re in a midterm election year. “The Market” doesn’t know what the Senate and U.S. House of Representatives will look like, come November. The market doesn’t like uncertainty, so it’s actually quite normal to experience heightened volatility for the first 10 ½ months of the year.

As a reminder, here’s the average performance of the S&P500 in all years vs. midterm election years (with a few variations):

Third, we’ve got a little geopolitical problem Russia’s 100,000 troops (according to U.S. intelligence) positioned just outside the Ukrainian border. If they invade without any opposition, there is also concern that China would invade Taiwan, and for that reason, the U.S. has already positioned aircraft carriers in the South China Sea to help discourage such action.

Of course, let’s all hope that there are no invasions… but if there are, recall that we’ve been here before. Russia invaded Crimea toward the end of the 2014 Sochi Olympics and they invaded Georgia on the first day of the Beijing Olympics in 2008, so maybe Putin has a thing about invasions and the Olympics? Who knows…

Oh yeah, and bonds are still a big, hot mess. All our models remain invested in senior loans (averaging > 4% interest) and short-term treasuries, as the bond market has continued to decline into 2022:

Past events like these haven’t resulted in long-term negative effects on the market. My friend Ryan Detrick, CMT (head of technical analysis at LPL Financial) pointed out on Monday that when the S&P500 has entered a fast correction in less than a month in the past… the next three, six, and 12 months aren’t all that bad. In fact, when observing the six prior occurrences, all time periods were positive with only one exception – 12 months after April of 2000, during the early stages of the dot-com bubble crash.

Rather, I think what we’re experiencing is some run-of-the-mill, midterm election year struggles, topped off with geopolitical seasoning that is more than stocks can handle, at least for now.

There are another five trading days left in the month of January, and it’ll be interesting to see how the month ends because with each month, we get another full 28-31 days of data for the long-term trends in the market. Depending on how the month closes, there may be reason to take some defensive action in our tactical, trend-following models, just in case things get worse than I anticipate.

Meanwhile, our Strategic (static) models remain 100% invested – and our Tactical (trend-following) models remain partially invested – with an overweight on the sectors, industry groups, and stocks exhibiting the highest relative strength in the market today. Examples include Industrials, Financials, Defensive Cyclicals, and Commodities, which continue to perform well as inflation and supply chain issues continue to take their toll on the U.S.

‘till next time!

Adam