Use the SALE to Max Out Your IRAs!

If you’re single or married and “wish you would’ve” put money into a Traditional or Roth IRA last year, we’ve got good news. You still can! The only problem? You’ve only got a couple weeks left if you filed (or if you’re going to file) your taxes by the normal tax filing deadline this year. If you extended your return, you have until you file your extension to contribute!

The maximum contribution for Traditional and Roth IRAs is $6,000 – or $7,000 if you’re over the age of 50. The only catch is, you need earned income in order to contribute to a Roth, so if you’re retired and you didn’t work part time last year, chances are, a Roth is likely off the table.

If you’re a business owner, you can still contribute to a SEP IRA up until your tax filing deadline and reduce your tax bill, dollar-for-dollar, by the amount you contribute. The maximum contribution for a SEP for the 2021 tax year is $58,000 or 25% of your income, whichever is less.

Again, for business owners, and also a dollar-for-dollar tax deduction… if you have a single-person 401(k) (also known as an “Owner-K” or “Uni-K”) and your company is set up as a sole proprietorship, single-member LLC, or C-corp, you can still contribute up to $19,500 (or $26,000 if you’re over 50 years of age) by your tax filing deadline with the possibility to add additional tax savings on top via Profit Sharing contributions, depending on your situation.

We have clients this year who are taking advantage of “all the above.” In fact, we even have one client who, with the help of Judd Depew at Pension Design Group (our Third Party Administrator), we were able to set up a Cash Balance Plan within the last few days of the 2021 calendar year, which gave this business owner the ability to:

Max out his 2021 401k with a $19,500 tax deduction,

Max out his 2021 401k Profit Sharing plan (an even bigger tax deduction), and

Contribute more than $120,000 to the Cash Balance Plan we created (and yes, that’s another tax deduction!).

…and if that’s not sweet enough, for all the individuals, couples, and business owners who have taken advantage of these opportunities, they’ve done so while the market continues to remain “on sale.”

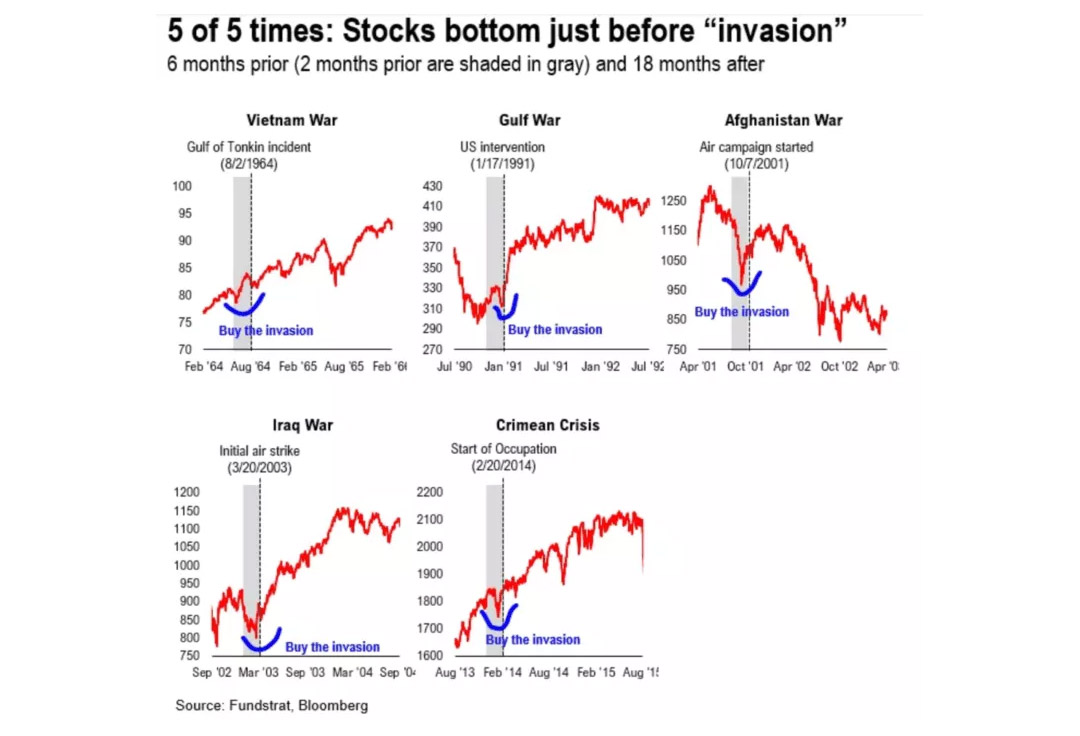

Not only is the market still on sale, but the things that are scaring investors these days (such as the Russian invasion of Ukraine) are the same things that have scared us in the past. However, when we look back at reality, what we find is that, in the vast majority of cases, the market ends up higher in the future, in spite of the “apocalypse du jour.”

Well… when the market falls, what usually happens is, instead of procrastinating due to the market being “expensive,” we humans feel scared – the thing that made the market go down creates fear and now, we want to “wait till things get better” (of course, what I hear is, “wait for prices to get higher before we buy”).

Seems kinda’ counterintuitive, doesn’t it? Well, humans have emotions, and those emotions make us sub-par investors!

How does one overcome their emotions? You create rules for yourself. For instance, if you’re wanting to invest cash that you have sitting on the sidelines:

You set a rule where, the next time the market drops more than 5%, you’re going to put the money to work, or

A better strategy, which is to split the money up into 2-3 “tranches,” and invest one tranche today, another one in two months, and the final tranche in four months, with the goal being to “catch the market on a bad day” (when the market is DOWN).

I have a crystal ball at my office that a client bought me years ago as a joke gift, and no… it doesn’t work. The point is, we never know when the market is going to fall, where the bottom is, and thus, we never know “the best time to invest,” so all we can do is create rules for ourselves that stacks the deck in our favor.

The same kinds of rules work if you’re needing to free up cash. For instance, we have a client right now who needs to sell a very large sum of an extremely volatile, low-basis investment, and he needs to do it this year. The fact that the sum of money is more than $10 million makes it difficult enough, but the fact that the cost basis is low and thus, the tax consequence could be high… well, that makes it even tougher!

Bottom line, the investment needs to be sold, so we know we’re going to have to pay the tax, and one of my favorite nerdy money jokes is:

“If you don’t want to sell your investments because you don’t want to pay the capital gains tax, then just hold onto the investment and the market will take care of your gains… then, you won’t have to worry about the tax anymore.”

Get it?

Anyway, what we’re doing in his case is the opposite of rule #2 above. Instead of investing in tranches, we’re going to sell in tranches. Whether it’s done once-per-week over the next 10 weeks or once-per-month over the next six months, the goal will be to “catch the market on a GOOD day” (when prices are high), understanding that we don’t know when those days will arrive, until they’re already behind us, but I digress…

The April tax filing deadline is coming up! So, unless you extended, make sure you’re taking advantage of all the tax deductions that are available to you, and remember, it’s not tax avoidance that will put you in jail – that’s tax evasion.

‘till next time!

Adam